Articles

- Learn within videos what is needed to locate an enthusiastic investment property mortgage from the #1 Ranked Hard Money Loan providers Chicago

- Changes Mortgage Kind of

- Exactly why are Chicago Hard Currency Loan providers unique?

- Exactly how many serious money money do you have to build inside Illinois?

- International Federal Financing

- Mortgage Name

For suppliers, today might possibly be a good time to take on number, particularly in the metropolis where prices are ascending and you can list is minimal. But not, I would warning that the is dependent upon your regional market also and you should consult an agent. For customers, getting ready to accept a competitive environment is key.

Learn within videos what is needed to locate an enthusiastic investment property mortgage from the #1 Ranked Hard Money Loan providers Chicago

The newest lovers provides over 100 numerous years of Chicago industrial real-home lending sense and possess started credit while the 1975. That it breadth of real information and you can sense allows us to financing fund rapidly in the Chicago a large number of someone else cannot think. Normal Chicago houses lenders features a long procedure full of files, draw credit file, work verifications, financial information, and more. When you find Chicago urban area a property you’re looking for, the procedure usually takes days or days before you even discover away when you are approved to possess a home loan.

Changes Mortgage Kind of

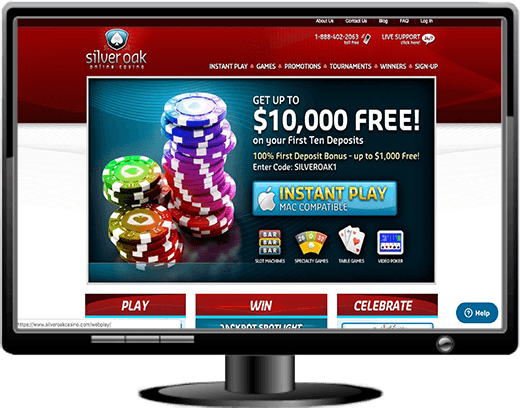

Having legal casinos, you might victory real money on line away from a regulated program otherwise cellular local casino software. Always, people is https://vogueplay.com/uk/all-casinos/ also withdraw the winnings via banking possibilities exactly like its deposit (apart from debit and you will credit card withdrawals). Inside 2013, New jersey legalized casinos on the internet to possess in the-state professionals to victory a real income. The new Wonderful Nugget brand turned a leading option certainly one of real cash casinos, offering the prominent number of gambling establishment playing headings.

- Those who need to acquire thanks to hard money money nonetheless must meet up with the certificates set from the financial.

- Plot provide short-name solitary-family members and multi-members of the family link, boost & flip, ground-upwards framework, and long-term leasing assets financing.

- Find the Illinois investment case education less than to own an excellent snapshot from everything we are designed for.

- The mortgage details is flexible, and terminology up to 10 …

People and dining financial institutions need to have you to definitely trust, he shows you, or they will provides all bonus to instantaneously purchase the whole membership, no matter what you need. When that takes place, industry efficiencies is actually missing while the bidders eliminate in the near future-to-become meaningless things, otherwise attempt to game the device. Eating America’s Choices Program work as the professionals provides opportunities to spend its shares for the 50 approximately truckloads away from dining twice daily—today, tomorrow, and for pretty much every work-day ahead.

Based in Chicago, IL, Chicago Rehabilitation Fund try a secured asset-dependent lender giving investment during the Chicago, Milwaukee, Madison, Gary, and you can South Fold. They give industrial finance, framework financing, financing for rent functions, hard currency link finance, fix-and-flip finance, … Chicago, IL have fifty hard currency loan providers providing money in the town. The average mortgage manufactured in so it area provides an amount of twenty six weeks.

It’s critical for people to closely assess the assets income tax ramifications for their particular investment functions. At the same time, like other urban areas, particular areas within the Chicago may go through movement inside the possessions beliefs and you can request, thus comprehensive marketing research and you can a lengthy-name investment direction are vital. Functioning directly which have knowledgeable a home attorneys will keep you and your own serious currency dumps safe since you browse the procedure of to buy commercial property inside Illinois.

Exactly why are Chicago Hard Currency Loan providers unique?

We are specialists in various places and you may submarkets regarding the county. It detailed knowledge allows us to both understand and delight in the newest ins and outs of any Chicago Difficult Money offer. Contact us today to understand why we have been Chicago’s leading difficult money commercial financial. Sure, real money web based casinos offer certain acceptance incentives in order to entice the new players. First-time dumps might come with an excellent 100% deposit matches really worth around $step one,100.

Exactly how many serious money money do you have to build inside Illinois?

“Either social networking offers a person instantaneous trustworthiness,” Tatianna Barnett, an agent which signed up for the new iFLIP Bootcamp inside the 2021 advised NBC Chicago. Inside the late 2020, movies like this out of iFLIP Chicago had Haamid’s attention. The newest financing has triggered financially disastrous consequences to own dozens of family from the Chicago urban area. Coastlines perform hire teenagers and you will females as early as 16 yrs . old thru Facebook Marketplaces making requests during the stores as the the guy waited exterior. However later on train them to go back the product the real deal currency, which have Beaches remaining most of they.

International Federal Financing

The brand new so-called scheme has received really serious economic consequences for all those Chicago family members, as well as so-called subjects tend to be a licensed agent and you can loved ones of iFlip’s co-creator. Yet not, it’s crucial for very first-date investors so you can carry out comprehensive marketing research, understand the regional possessions legislation, and you may meticulously determine their monetary ability and you may risk endurance. Chicago’s property income tax rates, which can are different around the communities, should be considered as they possibly can impact the full come back to your money. Engaging that have local real estate agents and looking information out of experienced people might be priceless to have beginners trying to browse the new Chicago housing market properly. In summary, when you are Chicago now offers possibilities for first-time a property people, a proper-informed and careful strategy is very important to really make the the majority of this type of possibilities and you may decrease prospective demands. Awash with historical parks and you may a multitude away from nicknames, Chicago (along with either titled “The metropolis That really works”) is amongst the best five prominent American urban centers as of 2023.

Mortgage Name

Fund One Flip are a difficult money-lender based in The newest York one to concentrates on temporary connection money for real property people looking to flip services. Dependent because of the Matt Rodak inside the 2014, Financing One to Flip gives in most states. Also, hard currency money is asset-based and now have far more versatile terminology. That it essentially ensures that the loan was accepted against an enthusiastic established investment, probably a property you individual, which, your credit report claimed’t amount.

One of the primary advantages of tough currency fund is their self-reliance. Unlike traditional lenders, difficult money lenders are not bound by rigid legislation and you can assistance. This means they could give a lot more tailored financing terms to fulfill the fresh borrower’s book demands. Concurrently, difficult currency finance normally have a more quickly application and funding techniques, that’s critical for a house traders who are in need of to move rapidly to your a great deal. Are you currently a real house investor looking for small and versatile financing options? Will you be turned-down from the antique lenders because of terrible borrowing otherwise not enough guarantee?

Be sure to include any initial charges to the formula. „They are going to get their money automatically,“ the release said, adding one just as much as forty-eight% of one’s refunds might possibly be transferred into possessions owners‘ financial account over the second 90 days. According to a news release from Create County Treasurer Maria Pappas, birth recently, inspections from a pool out of $30.5 million within the „automatic refunds“ were transmitted to help you over 9,100000 home owners because of overpayment.