Blogs

More resources for More Medicare Tax, visit Internal revenue service.gov/ADMTfaqs. To learn more from the workplace withholding conformity, find Internal revenue service.gov/WHC. Seasonal staff and personnel not already performing functions. The details are exactly the same such as Example 2, but your choose to spend Sharon an extra bonus away from $2,000 on 30. Having fun with supplemental wage withholding method 1b, you are doing another. Should your company don’t topic needed advice productivity, the newest point 3509 rates are the pursuing the.

Spend today or pay more than go out.

For those who pay extra earnings that have regular wages but never indicate the amount of for every, withhold government income tax since if the entire were an individual fee for a normal payroll months. You should assemble federal taxation, personnel societal defense taxation, and you can personnel Medicare income tax to your employee’s information. The newest withholding regulations to possess withholding a keen employee’s display away from Medicare tax on the resources along with apply to withholding the other Medicare Income tax just after wages and you can tips meet or exceed $two hundred,100 from the twelve months. If such money is actually for work other than inside the a trade or business, such residential operate in the new parent’s personal home, they’re also perhaps not susceptible to personal security and you can Medicare fees until the boy has reached ages 21. Although not, come across Secure features of a kid otherwise spouse, after. Payments for the characteristics out of a child lower than ages 21 whom works best for its mother, whether or not inside a trade otherwise team, commonly subject to FUTA taxation.

Processing Versions 941, Mode 943, Function 944, otherwise Form 945

- Solution costs commonly information; thus, withhold taxes for the solution costs as you perform for the regular wages.

- Comprehend the Recommendations to have Function 941-X, the new Tips to own Mode 943-X, and/or Recommendations to possess Mode 944-X to have information on learning to make the fresh variations otherwise allege to own reimburse or abatement.

- Records so you can “income tax” within guide pertain just to federal taxation.

- The brand new put periods for semiweekly agenda depositors are Wednesday thanks to Monday and you can Monday because of Saturday.

- Businesses inside the Puerto Rico, understand the Guidelines to possess Mode W-step three (PR) and you will Function W-3C (PR).

- Without having an early on Form W-4 that is valid, keep back tax because if the newest personnel had looked the container to have Solitary otherwise Partnered submitting separately inside Step 1(c) making no records in the 2, 3, or Step of your own 2025 Form W-4.

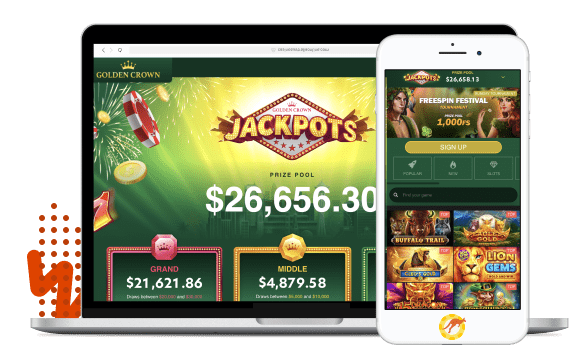

Rather children and people could play that it alien player game free of charge because the an on-line application here. Among them you’ll have the high ranked application to try out seller – Microgaming. By just seeing so it, i know already your own casino features joyous to experience choices to give to their benefits. In addition to this group, the fresh gambling enterprise uses many others reputable companies to create the brand new liberty from games you can find to their users. The video game of your gambling establishment are offered for the fresh mobileand pc, along with tablets. You have access to the better-technical games that have incredible, colourful picture of one devices when, therefore it is on-line casino extremely accessible and easy and make fool around with from.

But not, the fresh punishment to your dishonored money out of $twenty-four.99 or smaller is a price equal to the brand new payment. Such as, an excellent dishonored percentage away from $18 is actually energized a punishment out of $18. This video game has multiple great elements, from the great environment https://wheel-of-fortune-pokie.com/super-wheel/ and you will setting to their challenge and you may variety of account. It’s a vibrant city games that will allow one to experience long of fun – not surprising that professionals and you can admirers acknowledged this game a great deal. Conflict of 1’s Globes is a 2D Front side-Scroller, Action-Excitement and you can Miracle-System games same as Deadlight. The video game is founded on the storyline from a manuscript from the same label and will be offering letters your’re also accustomed.

To make use of the same-go out wire percentage means, you’ll want to make plans with your lender ahead of date. Excite consult your standard bank out of access, work deadlines, and you may costs. Debt establishment may charge you a charge for repayments produced like that. To learn more about every piece of information your’ll have to share with debt institution and make an excellent same-day cable commission, go to Irs.gov/SameDayWire. If the in initial deposit is required to be produced to your a day this isn’t a corporate go out, the brand new put is considered prompt in case it is produced by the fresh intimate of your 2nd business day.

Don’t send taxation concerns, taxation statements, or repayments to the more than target. You happen to be permitted apply for a fees contract on the web if you’re able to’t pay the full quantity of tax your debt once you document the a job taxation get back. To learn more, understand the recommendations for the a job income tax return or go to Irs.gov/OPA.

Army who’re stationed inside Puerto Rico but i have an excellent state of courtroom house outside Puerto Rico. To learn more, and information about doing Function W-2, visit Internal revenue service.gov/5517Agreements.. Treasury Department plus the CNMI Section of Funds and Income tax inserted for the a binding agreement less than 5 You.S.C. part 5517 in the December 2006. Government companies are necessary to file every quarter and you can annual accounts for the CNMI Division away from Funds and you can Taxation. Military that stationed regarding the CNMI but have a great condition from judge home outside the CNMI. A realtor that have a medication Function 2678 support give payroll and you may related tax responsibilities on the part of the brand new employer.

Federal Tax Withholding

- The brand new punishment don’t pertain if any incapacity to make a genuine and you will punctual put try due to realistic cause and not so you can willful overlook.

- In the event the over fifty% of the team who’re considering foods on the an employer’s company premises discovered such dishes to your convenience of the new workplace, all the meals provided on the premise try addressed as the provided to possess the handiness of the fresh company.

- To have reason for such security over qualification conditions, the definition of “federal taxes” comes with government income taxes that have been withheld away from settlement and almost every other number paid back so you can and transferred to your U.S.

- Within the 3000 Ad, Jonnie Goodboy Tyler stays in the fresh Rocky Slopes with a ring of cave-dwellers which worry the newest „demons“ one to laws World.

Form W-9 must be used when payees must approve that the amount supplied is right, otherwise whenever payees need approve that they’re not susceptible to copy withholding or is actually excused from copy withholding. The new Guidelines to your Requester of Setting W-9 is a summary of kind of payees who are excused of content withholding. 1281, Backup Withholding to have Forgotten and you will Incorrect Label/TIN(s). For individuals who document the a job tax go back electronically, you could elizabeth-document and employ EFW to spend the balance owed inside a single step using income tax preparing app or thanks to an income tax professional.

Cool next Friday standards aliens attack $step 1 put November 2024

/filters:quality(40)/1682421127/yebo-casino-lobby.png)

If the identity „You“ is employed inside book, it includes Western Samoa, Guam, the newest CNMI, the new USVI, and you will Puerto Rico, until if not listed. Licensed home business payroll tax credit to have growing look issues. For taxation years beginning prior to January step 1, 2023, a professional home business will get choose to claim to $250,100 of its borrowing to own growing look issues as the a great payroll taxation borrowing.

Visit Irs.gov/Versions to get into, down load, or print the variations, guidelines, and you will courses you need. In cases like this, the fresh certifying agency must post the new certification at least on the an annual base, no later than February 14. If the a manager outsources particular or every one of its payroll obligations, the newest workplace should think about the following suggestions. Yet not, for many who placed all the FUTA tax when due, you may also document to the or prior to February ten, 2025. Report latest quarter changes for portions away from cents, third-party unwell pay, tips, and you can classification-life insurance coverage for the Mode 941 using outlines 7–9, to your Function 943 using range ten, as well as on Setting 944 using range 6. To own quantity not safely or prompt deposited, the brand new penalty rates are listed below.

Discover Replacement employer, prior to within this section, to possess an exclusion. Below point 3121(z), a foreign person that match all of the following criteria are fundamentally managed while the an american boss to possess purposes of paying FICA taxes on the wages paid back so you can a member of staff who is a great U.S. resident or citizen. Withholding societal protection and you can Medicare taxes on the nonresident alien team. For those who’lso are not sure that wages that you shell out to an excellent farmworker within the year was nonexempt, you can either deduct the fresh income tax after you result in the payments otherwise hold back until the new $dos,500 attempt or perhaps the $150 test mentioned before has been came across. Earnings paid off in order to a child less than 18 focusing on a ranch which is a best proprietorship otherwise a partnership in which for each partner is actually a pops from a young child are not at the mercy of public shelter and you will Medicare taxes.